Gold surged to the new highest daily close in history at $2,391 on April 19, 2024. During this week Gold again rushed from one ATH to another at $2,382 on April 15, 2024 and $2,383 on April 16.

Gold smashed a new intraday all-time high at $2,430 on April 12, 2024, after it made a previous ATH at $2,377 on April 11, 2024. During that week Gold surged from one ATH to another at $2,339 on April 8, 2024, and $2,355 on April 9, 2024.

"Gold is coiling into the very powerful spring and knocking on the new all-time high "Heaven's Door". As with all generational Bull Markets, any price suppression and market manipulation can lead only to one thing: another opportunity to accumulate the best stories in the Gold mining junior space where new fortunes will be created in the next few years to come.

Nobody knows the future, but history can teach us about manias and "irrational exuberance" spilling over from chasing Crypto Dragons into real assets and solid values that some junior miners can represent in the marketplace."

"Only the patient investors who still can read, analyse and use the powerful organic intelligence tool - calculator, will be rewarded by the ruthless Mr Market. Only you can decide what to do after your own research and due diligence."

"We are getting closer to The Next Catalyst for Gold. The whole new generation of investors has to learn the hard way history lessons. They must find real, solid values after being used, disillusioned and thrown away by "The Ponzi on Steroids". "The Thousand and One" digitized scams known to humans remain scams even on the blockchains."

"High gold price reflects strong demandAnother year of blistering central bank buying, together with resilient jewellery consumption, offset sizable ETF outflows.Annual gold demand (excluding OTC) of 4,448t was 5% below a very strong 2022. Inclusive of significant OTC and stock flows (398t), total gold demand in 2023 was the highest on record at 4,899t.

Central bank buying maintained a breakneck pace. Annual net purchases of 1,037t almost matched the 2022 record, falling just 45t short." (World Gold Council, 31 January 2024)

"There is no Gold 2.0, there are over 5,000 years of humankind's history with Gold. Investors are tired of losing money by chasing Crypto Dragons and Bitcoin Dreams in the Tether Metaverse."

"My belief is TNR's Shotgun Gold Project can potentially grow and become a foremost, immediate satellite site Gold deposit to Donlin Gold's Mining Camp infrastructure. This vision is based on our exploration work and academic studies like the ones from Dr Tim Baker in which Shotgun Gold Project is not only listed alongside Donlin Creek as one of the "Major Porphyry Gold Deposits" but is also projected to contain the similar porphyry intrusion-related type system as Donlin."

Kirill Klip, Executive Chairman

TNR Gold Corp.

"A recently published research report on TNR, written by Fundamental Research Corp, reckons fair value for the company at C$0.22 per share. The current price is significantly lower than half of that." (Alastair Ford)

Disclaimer: Please be aware that any opinions, estimates or forecasts regarding the performance of TNR Gold Corp. in any research reports do not represent the opinions, estimates or forecasts of TNR Gold Corp. or of its management.

My Vision for TNR Gold and Strategy: Share Buyback, Potential Valuations, and Shotgun Gold Project Spinout

“We are building The Green Energy Metals Royalty and Gold Company. Our business model provides the unique entry point into the creation of supply chains for critical materials like energy metals which are powering Tesla Energy rEVolution and Gold industry which is providing the ultimate hedge during this part of the economic cycle. Our shareholders are participating in the building of The Green Energy Metals Royalty and Gold Company. In our portfolio, we have a unique combination of assets providing exposure to different parts of mining cycle: starting with the power of blue sky discovery and including partnerships with industry leaders like McEwen Mining, Ganfeng Lithium and Lundin Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”Kirill Klip, Executive Chairman TNR Gold Corp.

Today I would like to present our strategy for the Shotgun Gold Project in more detail for all our shareholders.

TNR Gold – AmeriGold – Shotgun Gold

The Company’s strategy with the Shotgun Gold Project is to attract a partnership with one of the major gold mining companies. TNR is actively introducing the project to interested parties. We may be at the beginning of a great discovery. There is a clear path on how to move this project forward using the geological and geophysical research currently available to target drilling to expand the resource and form the basis of a preliminary economic analysis. The next step is to acquire a partner who shares our vision and recognizes the growth potential and value to be added to the Shotgun project over time.

Our strategy presented to potential strategic partners involves the creation of a JV with one of the major gold mining companies when our partner will be investing very substantial capital in the development of the Shotgun Gold Project while earning a stake in the project.

TNR Gold shareholders will benefit from the strategic partner’s capital being invested “in the ground” and industry expertise, including operations in Alaska.

The Management is investigating the best value creation strategies for the Shotgun Gold Project and has put in place the corporate structure of AmeriGold – the stand-alone company that could potentially inherit the Shotgun Gold Project JV operations after the contemplated potential spinout from TNR Gold.

This article is for information only and provides publicly available information and my personal Vision and valuation matrix of TNR Gold. I am the largest individual shareholder of our Company. Nothing in this blog post constitutes investment advice, offer or solicitation of the sale of any securities. Please carefully read all our Legal Disclaimers and conduct your own due diligence as always.

Thank you for your support of TNR Gold!

Tesla Nicola rEVolution and Gold.

Proactive:

"TNR Gold’s track record of successful deals with majors like Ganfeng and McEwen Mining should stand it in good stead as manoeuvring continues on the Tintina gold belt.

“I believe the Shotgun gold project could become one of the main satellite gold projects of the Donlin gold camp,” says Kirill Klip, the chief executive and largest shareholder of TNR Gold Corp (CVE:TNR).

Shotgun is the flagship asset of TNR, and is located to the south of Donlin, just inside the boundary of the famous Tintina gold belt which arcs right across Alaska.

It’s a gold belt that has proved prolific in delivering up sizeable discoveries over the years, and now boasts a serious number of major producing mines, including at their forefront, the Pogo mine, owned by Northern Star Resources (ASX:NST) and the Fort Knox mine, owned by Kinross (TSE:K).

But Donlin takes things to another level again.

With its 39mln ounces of gold grading well over two grams per tonne, it’s one of the largest open pit deposits anywhere in the world.

Not surprising then that one of the biggest names in the industry, Barrick Gold (TSE:ABX), is playing a crucial role in bringing it on, alongside partner NovaGold (TSE:NG).

Will these two stay as partners for the duration, or will Barrick step in and buy out NovaGold?

Or, for that matter, will a third party, like Newmont, show up late at the party and try to initiate some sort of division of the spoils with Barrick along the lines of the current hard-won arrangement in Nevada?

These are matters for speculation just at the minute, but it might not be long before we see tangible corporate action.

And it’s not altogether out of the question that Shotgun will get caught up in it too.

After all, TNR has plenty of form in forming strong alliances with the world’s leading mining companies.

In an earlier phase of its existence it made two major discoveries in Argentina, the Los Azules copper project, now being brought forward by McEwen Mining (TSE:MUX), and the Mariana lithium project, now being brought forward by Ganfeng Lithium. After some adroit deal-making TNR managed to retain substantial royalties in these projects, such that when they come on stream it’s likely that Los Azules will contribute upwards of US$3.5mln per year to the TNR coffers, with Mariana providing a further US$1mln. However, the latter estimate was made by the analyst before Ganfeng announced an increase of the lithium resource at Mariana of more than 250%.

This background of successful deal-making with majors ought to provide TNR with a real advantage when it comes to assessing options for Shotgun in the coming months.

To some degree, it’s a fairly simple exercise for investors to form an idea of what the future holds, but in the case of Shotgun Klip is keen that TNR ends up retaining a 25% interest, rather than just a royalty.

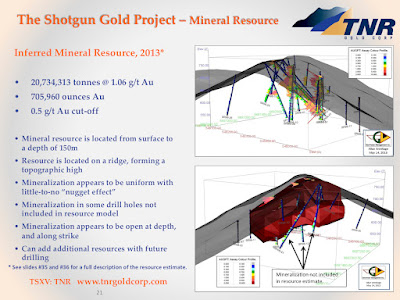

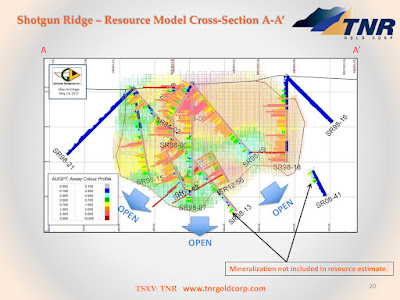

In this, he does have some room for manoeuvre, because Shotgun isn’t just another piece of prospective ground. Rather, the project already boasts an inferred resource of over 700,000 ounces of gold at Shotgun Ridge, and shows every sign of being able to deliver a markedly larger total than that, once the next major exploration programme delivers its results.

Shotgun Ridge is just one of multiple gold target areas controlled by TNR Gold. ‘Shot’, ‘King’ and ‘Winchester’ add to the collection to form a distinct gold district with five separate targets identified so far

When that will be though is the big question.

To take Shotgun up to the next level, Klip is clear that a major exploration spend is required – upwards of US$5mln and ideally closer to US$10mln. On one scenario he could go into the market and raise that money himself.

But here’s where his position as a major shareholder in the company becomes key.

“Even a US$5mln raise would be very dilutive to all our shareholders at this stage and will not guarantee success,” he says.

“We need to bring US$10mln in to drill the project very strongly.

The first US$5mln to take the project from the current 700,000 ounce resource up to the two million ounce mark, the rest to drill out the five nearby targets. There’s no reason to suppose that our ground cannot hold multiple mineralised systems.”

At Shotgun the thinking is that there may be upwards of five million ounces of gold in the ground, and there is precedent. At this stage the geology shows remarkable similarity to Donlin.

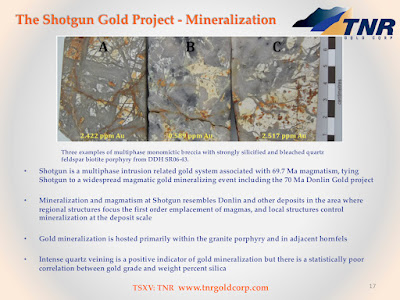

An academic study conducted in 2001 by Lang & Baker specifically identifies both projects as ‘major porphyry granite related gold deposits’ related to a singular widespread magmatic gold mineralising event that constitutes this horseshoe-like region.

The implication is that both projects arose from the same geographical kitchen sink, leading to the reasonable supposition that they should possess similar favourable geological properties.

“We are talking about a high tonnage bulk system,” says Klip. “There are no nuggets, it’s very uniform.”

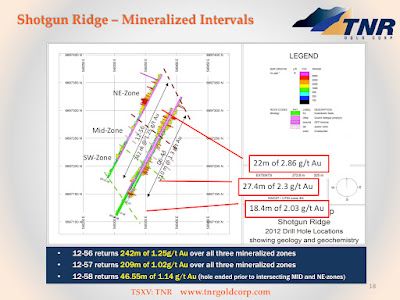

Shotgun’s particular boon is in the details. Shotgun’s mineralisation has been shown to possess little-to-no ‘nugget effect’. A high ‘nugget effect’ means high variability between samples that are closely spaced. ‘No nugget effect’ implies a tight and uniform mineralisation of a bulk tonnage gold system. So there’s no need to dig up empty rock space as one does when chasing a vein so the stripping ratio for any mine will be low, keeping costs down.

Among the notable intercepts already banked, the company boasts 242 metres grading 1.25 grams gold per tonne, 209 metres at 1.02 grams, and just under 47 metres at 1.14 grams.

What’s more, the gold that’s been identified thus far sits at the top of a ridge, meaning that the stripping ratio for any mine will be low, which in turn will keep costs down.

“I’m in the business to get the maximum out of this new gold bull market. We’ve been waiting for it for nearly ten years after 2011. I just need to get the best deal,” says Klip

“We are not dreamers. We did it with the copper. We did it with the lithium. I would like to make it even bigger with the gold. I would like to do better, to keep a 25% stake.”

Not for him as a shareholder the dilutive effects of repeated equity fundings to support exploration. His favored option – of bringing a major in – would in the end, he calculates, mean that current shareholders end up retaining more of the project, and hence more of the value, in the long-term.

Will the strategy work?

Well, it already shows every sign of doing so.

“A deal could happen any day,” says Klip.

“Literally. We are seeing interest. But we are not in any hurry. The interest at the moment is from mid-sized companies. I do not like to commit to shallow money with sums that look great on paper but come from parties that lack the appropriate technical and financial depth with consistent follow-through in the years following the deal. We hold the high ground. We want to be patient and attract the best of the best, like we did with Ganfeng Lithium years ago - one of the top gold major company to make sure that we can get the absolute most of Shotgun’s resources in development.”

For now, the company is actively introducing Shotgun Gold to potential partners and is much more open to drilling the entirety of these prospects in a strong fashion so that it can expand the known area of mineralisation and conclusively assess the project’s top-end valuation.

And it’s in this context that the royalty portfolio cleaves once more into view. These are serious assets, and they promise cashflow in the near-term. There’s significant value in the company on their strength alone. All of which means that TNR isn’t like some other juniors, desperately lurching from one equity raise to the next simply to keep going. There’s far more to it than that. In fact, there’s a carefully thought out strategy that looks likely to reap significant benefits for shareholders in the near-to-medium term."